The Basics of Loan Calculators

A **Loan Calculator** is a digital tool designed to assist debtors estimate their monthly payments based mostly on various components including the loan amount, rate of interest, and mortgage time period. By inputting these variables, customers can obtain immediate calculations that present a clearer image of their financial commitments. This helps in budgeting and planning for repayme

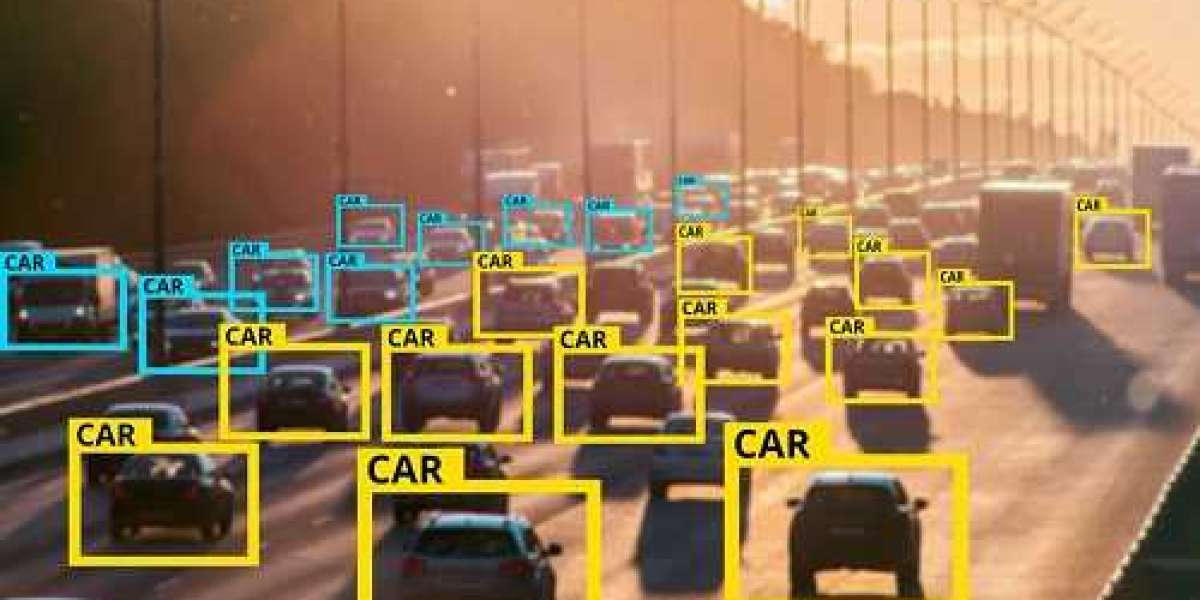

When contemplating a new vehicle purchase, understanding auto loans is essential. These loans are tailor-made for automotive financing, enabling you to drive your dream vehicle without straining your finances. With a massive number of lenders and plans out there, it becomes important to conduct thorough analysis to safe phrases which might be favorable. Furthermore, valuable assets, 이지론 such because the detailed reviews and information found at Beepick, can information you in making informed decisions regarding auto lo

Lastly, some calculators come outfitted with instructional sources, regularly requested questions, and suggestions for understanding loans better. Opting for such calculators can improve the overall experience and supply users with valuable informat

Key Factors Influencing Loan Approval

Several key elements affect mortgage approval and the terms provided to debtors. *Credit history* is paramount; lenders assess your credit score report to evaluate your past borrowing conduct. A consistent historical past of on-time funds could result in decrease rates of interest and better borrowing lim

Typically, Debt Consolidation Loans could be secured or unsecured. A secured mortgage requires collateral, such as a house or car, while an unsecured loan does not. It's important to weigh the advantages of each sort primarily based on private financial circumstances. Through this strategy, debtors can regain management over their money owed and create a extra manageable monetary strat

In addition to academic materials, Bepick additionally options consumer reviews and experiences with different pawnshops, enabling potential borrowers to make informed selections. Understanding the popularity and service ranges of assorted pawnshops can significantly affect the mortgage expertise, and Bepick is dedicated to providing that requisite informat

Bepick: Your Pawnshop Loan Guide

Bepick is a comprehensive online resource devoted to offering detailed info and critiques about pawnshop loans. The platform aims to empower consumers by delivering essential insights into how pawn loans work and what to consider earlier than opting for this financial solut

Post-application, approval instances can range significantly. Traditional banks may take longer, whereas online lenders have a tendency to supply quicker, more streamlined processes. Understanding these dynamics can help entrepreneurs handle their expectations and timeline for fund

Day Laborer Loans is often a priceless financial device for these within the day labor workforce. By understanding how these loans perform and what to contemplate before applying, people can better navigate their monetary panorama. Resources like BePik additional empower borrowers to make informed choices, fostering a more sustainable method to managing funds. Ultimately, with careful planning and information, day laborers can take cost of their financial fut

A Loan Calculator is a tool that helps you estimate your month-to-month loan payments based on the Non-Visit Loan quantity, rate of interest, and period of the mortgage. It's important for planning your finances, because it lets you understand how a lot you'll owe every month, making it easier to price ra

Furthermore, it’s crucial to make sure the calculator is from a reputable supply. Sites like 베픽 offer thorough evaluations of various Loan Calculators, assessing their accuracy, ease of use, and different key functions. This can guide customers in making informed decisions when selecting a calculator that meets their wa

However, it’s important to note that whereas Loan Calculators are helpful, they lack some particular personalised inputs, similar to credit score rating or additional charges. Hence, whereas they provide a good estimate, consulting a financial advisor is all the time beneficial for personalized adv

Next, you must conduct research on numerous lenders. Online platforms like Beepick provide a plethora of details about different lenders and their respective offerings. Comparing rates of interest, terms, and fees will let you make educated decisions and identify the most effective matches for your financial state of affairs. Once you've got chosen a lender, the appliance can be submitted online or in individual, depending on lender preferen

Additionally, people ought to consider their spending habits and whether or not they can commit to not accumulating additional debt after the consolidation. Establishing a price range is crucial for long-term success, as failing to do so could result in a cycle of d

susieanthony8

1 Blog posts