Neobanking Market: A Comprehensive Overview

Market Overview

Neobanking, a transformative force in the financial services industry, represents a significant shift from traditional banking paradigms. Unlike traditional banks, neobanks operate entirely online without any physical branches. Leveraging advanced technologies such as artificial intelligence (AI), blockchain, and big data, neobanks offer a range of banking services, from basic account management to sophisticated financial planning tools. This digital-first approach caters to the modern consumer's demand for convenience, speed, and personalized service.

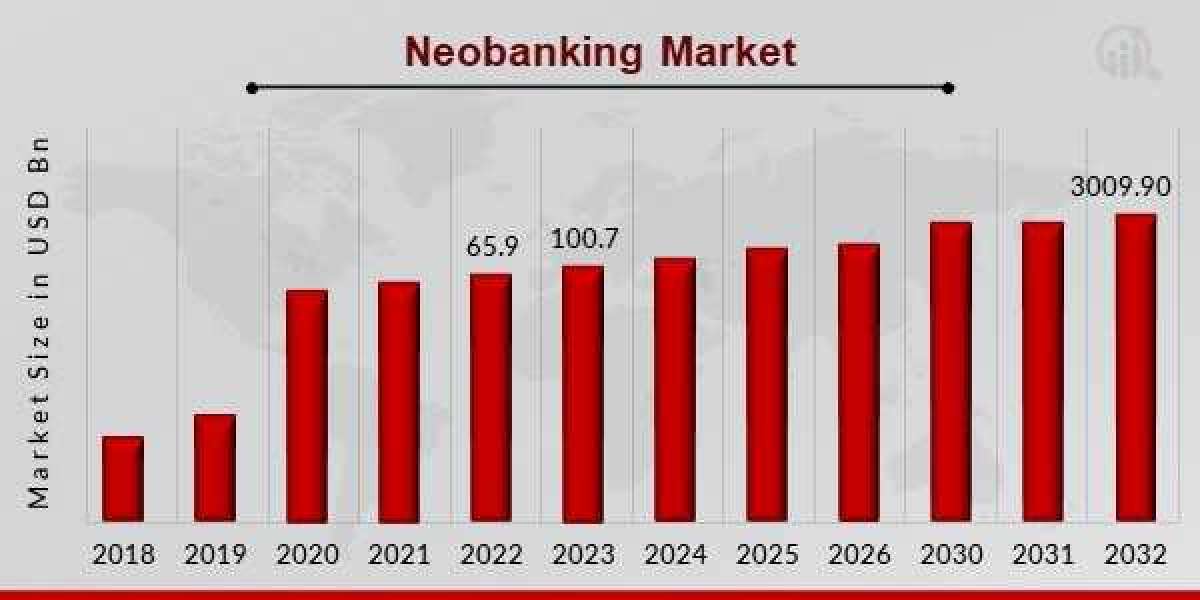

The global neobanking market has been experiencing robust growth, driven by the increasing penetration of the internet and smartphones, changing consumer behavior, and the desire for more efficient and transparent banking solutions. The Neobanking market industry is projected to grow from USD 100.7 Billion in 2023 to USD 3009.90 Billion by 2032.

Request To Free Sample of This Strategic Report - https://www.marketresearchfuture.com/sample_request/12100

Key Market Segments

1. Service Type

- Payment and Money Transfer Services: These include peer-to-peer transfers, international remittances, and bill payments.

- Loans and Advances: Neobanks offer personal loans, business loans, and credit facilities with competitive interest rates and flexible terms.

- Savings Accounts: Digital savings accounts with higher interest rates compared to traditional banks, due to lower overhead costs.

- Insurance Services: Integration with insurance providers to offer health, life, and property insurance.

2. End User

- Retail Consumers: Individuals using neobanks for personal banking needs, benefiting from lower fees and higher interest rates on deposits.

- Businesses: Small and medium-sized enterprises (SMEs) and startups leveraging neobanking services for business accounts, payroll management, and financing solutions.

3. Application

- Personal Banking: Managing personal finances, savings, and investments through user-friendly mobile apps.

- Enterprise Banking: Streamlined banking services for businesses, including invoicing, expense management, and corporate cards.

Industry Latest News

In recent developments, the neobanking industry has witnessed several significant trends and events:

- Expansion of Services: Many neobanks are expanding their service offerings beyond traditional banking services. For instance, some neobanks now provide investment opportunities, cryptocurrency trading, and financial advisory services.

- Strategic Partnerships: Neobanks are forming alliances with fintech companies, technology providers, and traditional banks to enhance their service delivery and expand their market reach. For example, partnerships with payment processing companies enable neobanks to offer seamless international transactions.

- Regulatory Approvals: Regulatory bodies in various regions are increasingly recognizing and granting licenses to neobanks, ensuring that they comply with financial regulations and standards. This has bolstered consumer confidence and facilitated market expansion.

- Technological Advancements: The adoption of AI, machine learning, and blockchain technology continues to revolutionize neobanking. These technologies enhance security, provide personalized banking experiences, and streamline operations.

- Funding and Investments: The neobanking sector has attracted substantial investment from venture capitalists and private equity firms. This influx of capital is fueling innovation and enabling neobanks to scale their operations rapidly.

Key Companies

Several key players dominate the neobanking market, each offering unique value propositions:

- N26: A German neobank known for its user-friendly interface and transparent fee structure. N26 offers a range of services, including personal and business accounts, international money transfers, and budgeting tools.

- Revolut: A UK-based neobank that provides services such as currency exchange, cryptocurrency trading, and stock trading, in addition to traditional banking services.

- Chime: An American neobank focused on providing fee-free banking services, including savings and checking accounts, early direct deposit, and automated savings features.

- Monzo: A UK-based neobank offering personal and business banking services with features like spending insights, savings pots, and overdraft facilities.

- Varo: The first fully digital bank in the US to receive a national bank charter, offering a range of banking services, including high-yield savings accounts and personal loans.

Market Drivers

The growth of the neobanking market is propelled by several key drivers:

- Digital Transformation: The widespread adoption of digital technologies and the increasing reliance on smartphones and the internet are driving the demand for digital banking services.

- Changing Consumer Preferences: Modern consumers prefer convenient, transparent, and personalized banking services, which neobanks are well-positioned to provide.

- Cost Efficiency: Neobanks operate with lower overhead costs compared to traditional banks, allowing them to offer competitive rates and lower fees.

- Financial Inclusion: Neobanks are reaching underserved and unbanked populations by offering accessible and affordable banking solutions.

- Regulatory Support: Increasing regulatory support and the establishment of fintech-friendly policies are facilitating the growth of the neobanking sector.

Ask for Customization - https://www.marketresearchfuture.com/ask_for_customize/12100

Regional Insights

The neobanking market exhibits significant regional variations, with distinct trends and growth patterns across different geographies:

1. North America

North America, particularly the United States, is a major market for neobanking. The region's advanced technological infrastructure, high smartphone penetration, and consumer preference for digital banking drive market growth. Regulatory developments, such as the approval of digital bank charters, further bolster the market.

2. Europe

Europe is home to several prominent neobanks, including N26 and Revolut. The region's supportive regulatory environment, coupled with a tech-savvy population, fosters a thriving neobanking ecosystem. The European Union's revised Payment Services Directive (PSD2) has also facilitated the growth of neobanks by promoting competition and innovation in the financial sector.

3. Asia-Pacific

The Asia-Pacific region is experiencing rapid growth in the neobanking market, driven by increasing internet penetration, a large unbanked population, and supportive government initiatives. Countries like India and China are witnessing the emergence of numerous neobanks catering to the needs of tech-savvy consumers and small businesses.

4. Latin America

Latin America presents significant growth opportunities for neobanks, with a large unbanked population and increasing smartphone adoption. Neobanks in the region are leveraging digital platforms to offer accessible and affordable banking services, promoting financial inclusion.

5. Middle East and Africa

The Middle East and Africa region is gradually embracing neobanking, with growing internet penetration and supportive regulatory frameworks. Neobanks are playing a crucial role in promoting financial inclusion and providing banking services to underserved populations.

Conclusion

The neobanking market is poised for remarkable growth, driven by technological advancements, changing consumer preferences, and supportive regulatory environments. Key players are continuously innovating and expanding their service offerings to cater to the evolving needs of modern consumers. As the market matures, neobanks are expected to play an increasingly significant role in the global financial landscape, transforming how banking services are delivered and experienced.

Neobanking Market Highlights: